Investing might seem out of reach when you’re on a tight budget, but small, consistent savings can lead to significant financial growth over time.

One of the best examples is the daily coffee habit—many people spend $3 to $5 per day on coffee without realizing how much that adds up over months and years.

Instead of cutting out coffee entirely, redirecting a portion of that spending into investments can help build a strong financial future without requiring large upfront capital.

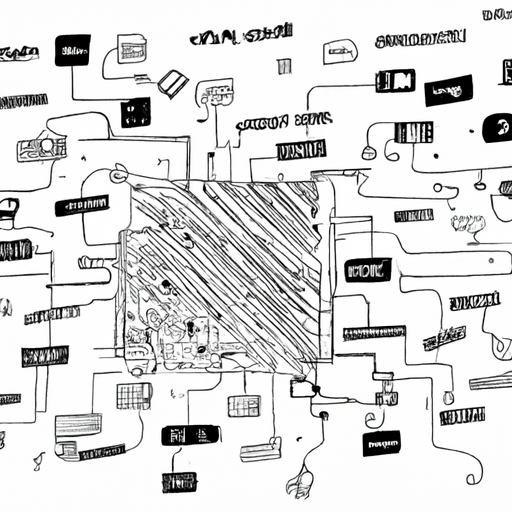

8 Steps to Create an Investment Plan from Your Daily Coffee Savings

Here’s how to turn your daily coffee savings into a smart, long-term investment plan.

1. Track Your Coffee Spending and Set a Realistic Savings Goal

Before making any investment, it’s important to understand how much you’re actually spending on coffee. The best way to do this is to track every coffee purchase for a month.

For example, if you buy a $4 coffee five times a week, that’s $20 per week or around $80 per month. Over a year, this adds up to nearly $1,000—a significant amount that could be invested instead of spent on daily caffeine fixes.

You don’t need to give up coffee entirely. Instead, decide on a reasonable percentage to redirect into investments—even saving just $2 per day can create a meaningful impact over time.

2. Automate Your Coffee Savings into an Investment Account

Many people intend to invest but forget or delay taking action. The best way to ensure consistency is to automate the process by setting up a small, recurring transfer to an investment account.

For example, if you decide to save $2 per day from coffee spending, you can set up a recurring weekly transfer of $14 into an investment account. Apps like Acorns, Betterment, or M1 Finance make it easy to automatically invest spare change or small amounts into diversified portfolios.

3. Start with a Low-Cost Index Fund or ETF

If you’re new to investing, the easiest way to start is by putting your coffee savings into low-cost index funds or ETFs. These investment vehicles spread your money across multiple companies, reducing risk while ensuring long-term growth.

For example, investing in an S&P 500 index fund allows you to own shares in 500 of the largest U.S. companies, offering steady returns over time. Even small contributions compound significantly when invested consistently.

4. Use Fractional Shares to Buy Expensive Stocks with Small Contributions

Some people hesitate to invest because they believe they need hundreds or thousands of dollars to buy stocks. However, fractional shares allow you to buy small portions of high-priced stocks like Apple, Amazon, or Tesla with just a few dollars.

This means that instead of waiting until you have $3,000 to buy a full share of a stock, you can start investing today with just a few dollars from your coffee savings. Many brokerage platforms like Robinhood, Fidelity, and Charles Schwab offer fractional investing, making it easier to build a diverse portfolio.

5. Reinvest Dividends for Compounding Growth

Many stocks and ETFs pay dividends, which are small payments to shareholders. Instead of withdrawing this money, setting up automatic dividend reinvestment ensures that your returns compound over time.

For example, if you earn $10 in dividends, reinvesting it buys more shares, which in turn generate more dividends in the future. This process continues, allowing your investments to grow exponentially without needing additional contributions from your paycheck.

6. Explore Alternative Investments with Small Contributions

Investing doesn’t have to be limited to stocks. Your daily coffee savings can also be directed into alternative investment options, such as:

- Real estate crowdfunding through platforms like Fundrise or RealtyMogul.

- Peer-to-peer lending, where you lend small amounts to individuals or businesses in exchange for interest payments.

- Sustainable investments, such as green bonds or ESG-focused funds.

These options allow for diversification, ensuring that your portfolio grows steadily across multiple asset classes.

7. Increase Your Contributions as Your Budget Allows

When you start investing with small amounts, it’s important to increase contributions over time as your income grows or your spending habits change.

For example, if you initially save $2 per day, increasing it to $3 or $4 per day after a few months accelerates investment growth. Even small increases significantly impact long-term results, thanks to compounding interest.

One strategy is to redirect additional savings from other areas—such as dining out, impulse purchases, or unused subscriptions—into your investment plan.

8. Stay Consistent and Think Long-Term

One of the biggest mistakes new investors make is giving up too soon because they don’t see immediate results. Investing works best when it’s consistent and long-term—even small daily savings can grow into substantial wealth over decades.

For example, saving and investing $2 per day ($60 per month) at an 8% annual return can result in:

- $7,300 in 5 years

- $17,400 in 10 years

- $52,000 in 20 years

The key is to stick to the plan, avoid panic-selling, and reinvest earnings to maximize long-term gains.

Final Thoughts

Turning your daily coffee savings into an investment plan is a realistic and achievable way to build wealth over time. By consistently saving small amounts, automating contributions, reinvesting earnings, and diversifying your investments, you can create a strong financial future without making drastic lifestyle changes.

The most important part is starting today—even the smallest investments, when made consistently, have the power to grow into life-changing financial security over time.